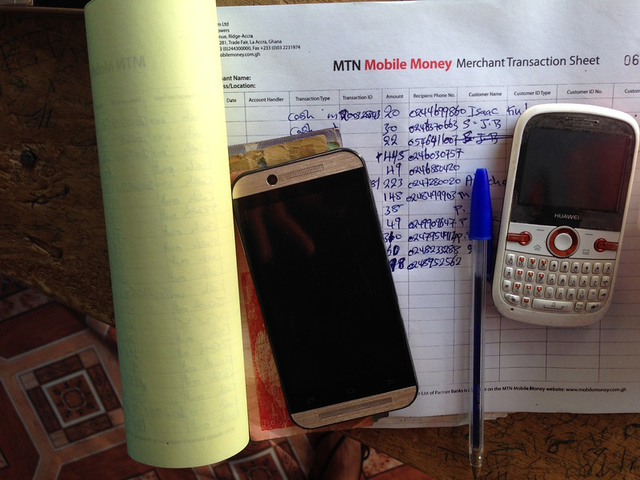

Mobile money is a digital financial service that allows individuals to use their mobile phones to store, send, and receive money. It can play an important role in improving international development programs in Low and Middle-Income Countries (LMICs).

Six Mobile Money Benefits in Development

- Financial Inclusion: Mobile money can help to increase financial inclusion by providing access to financial services for people who are excluded from the traditional banking system. This can help to reduce poverty and improve the standard of living for people in LMICs.

- Improved access to finance: Mobile money can provide a convenient and accessible way for people to store, send, and receive money, even in remote or underserved areas. This can help to improve access to finance for those who need it most, and can increase economic opportunity and growth.

- Increased efficiency: Mobile money can increase the efficiency of financial transactions by reducing the time and cost associated with traditional banking systems. This can make it easier for international development programs to send funds to the countries and organizations that need them.

- Improved data management: Mobile money can provide valuable data on financial transactions and behavior, which can be used to inform decision-making and improve development programs.

- Enhanced security: Mobile money can provide a secure way of storing and transferring funds, reducing the risk of fraud and corruption in the development sector.

- Increased transparency: Mobile money can provide a transparent way of tracking the flow of funds, increasing accountability and reducing the risk of fraud and corruption.

Mobile money can play a significant role in improving international development programs in LMICs. By increasing financial inclusion, improving access to finance, and enhancing efficiency and security, mobile money can help to reduce poverty, promote economic growth, and create a more equitable society.

Apply Now: $50,000 for Your Last Mile Mobile Money Startup Idea

Thoughtfully designed digital financial services such as better access to working capital, on/off ramps from physical to digital and cryptocurrency solutions, affordable...

The Benefits of Central Bank Digital Currencies for African Countries

The evolution of money and payment systems delivers is creating new opportunities and business models alongside new challenges. As economies are becoming more digital,...

5 Ways to Implement 9 UN Principles for Responsible Digital Payments

The transformative power of digital payments will be invaluable in rebuilding economies from the wreckage of the COVID-19 pandemic, especially for women and girls...

Apply Now: $37,000 for Your African Financial Technology Innovation

Digital financial services are contributing to financial inclusion for Africans – almost 40% of the world’s population. The rapid spread of mobile money...

Apply Now: $130,000 FinTech Innovation Startup Funding from VISA

Innovation in digital financial services is allowing Africans to move up the “financial services value chain.” From mobile money payments, customers in sub-Saharan...

5 Lessons Learned Using Digital Financial Services for COVID-19 Relief

Many countries have launched unprecedented relief packages to cushion the economic and social impact of the COVID-19 pandemic. Information is still limited on how...

How to Use Digital Payments During COVID-19 Response

The pandemic is affecting the way people interact with money; how much we spend, what we buy, and whether to opt for digital payments. In the US the switch to digital...

The State of Mobile Money in Southern African Countries

Being a young Zimbabwean who holds no faith in our banking system – mobile money has been a big part of my life. Around 49% of Zimbabweans are registered with...

What Are the Top 4 Mobile Money Purchases by African Youth?

Digital financial services in sub-Saharan Africa are changing rapidly with diversity in usage and uptake on such a diverse continent. Recently, GeoPoll embarked...

Apply Now: £1,760,000 for Your Agriculture Technology Innovation

Smallholder farming is a challenging enterprise. There are around 500 million smallholder farmers in the world, and they produce up to 80% of the food consumed...